Home Equity Is Skyrocketing; Here’s Why People Aren’t Tapping It

Recent Posts

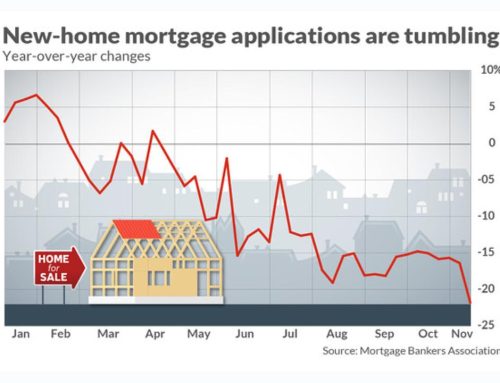

Americans now have more home equity than ever. According to recent data, homeowners are sitting on more than $6 trillion in tappable equity—an increase of $636 billion just this year. Compare that to six years ago, when equity bottomed out, and tappable equity has jumped 300% since 2012.

By way of home equity loans and lines of credit (HELOCs), home equity can be used for a number of purposes—to pay off debts, to cover renovation projects or even just take a much-needed vacation. But despite its versatility—and the sheer magnitude of available equity—home equity lending isn’t rising in step. Read on to find out why.

The article is written by Aly Yale for Forbes Online. You can read the full article here.

Sheila Abai is a senior mortgage consultant. She utilizes her 20+ years of finance and mortgage experience to identify the best mortgage and refinancing solutions for her clients. Sheila can be contacted via email at sheilaabai10@gmail.com or via telephone at (310) 666-6601.